Sara Omaniio Collections is

a Nigeria secondary fashion-based manufacturer and distributor of fashion accessories, with the primary intention of

adding beauty, candor and style to the looks of lovers of fashion using our

very own local Ankara fabrics. Sara Omaniio fashion accessories are often used to complete an

outfit or specifically to complement the wearer's look. It has the

capacity to further express an individual’s African identity and personality as

there are accessories that come in different, shapes, sizes, hues, etc.

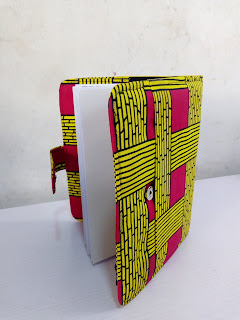

Sara Omaniio Collections has a unique style that stand it out from among other fashion houses and collections. It brings freshness and innovation to the fashion industry through the adoption of Ankara. Ankara is adopted not just for its beauty and freshness, but for what it represents in the African culture and for its place of pride in the hearts of the people of Africa and lovers of African culture worldwide. All the accessories are carefully handstitched and are all body friendly.

Sara Omaniio Collections spread its production across the two major categories of fashion: those that are carried and those that are worn. Traditionally carried accessories include purses and handbags, glasses, hand fans, parasols, umbrellas, wallets, Ladies bags, iPad clutches, bangles, school bags for children and adults. Accessories that are worn may include jackets, boots, shoes, cravats, ties, hats, bonnets, belts, gloves, necklaces, bracelets, watches, sashes, shawls, scarves, lanyards, socks, pins, piercings, ear-rings, and stockings. All the accessories that are “worn” have a touch of our brand “Ankara”. They could be already-made wears like jeans, t-shirts, shoes, earrings, etc made from other fashion houses or those made by our professional designers but it must have our transformational touch of Ankara before it will be worthy to carry the Sara Omaniio collections brand signature.

The type of accessory that an individual chooses to wear or carry to complement their outfit can be determined by several factors including the specific context of where the individual is going. For example, if an individual is going to work their choice of accessory would differ to one who is going out to drinks or dinner thus depending on work or play, different accessories would be chosen. Similarly, an individual's economic status, religious and cultural background would also be a contributing factor. In Sara Omaniio Collections, we cover the fashion needs of all persons across all social strata and economic status, occasions and events.

Sara Omaniio Collections produces and delivers souvenirs for any event or program from weddings, burials, political parties events, seminars, summits/symposium, birthday parties, etc across the 36 states of Nigeria and across the borders. All done according to the specifications of the contact person.

Find everything from chic

leather belts and eye-catching hats to evocative eyewear from this season’s

most sought after designers “Sara

Omaniio Collections”

Our Factory is located in Garki Abuaj, how ever we are not far from your reach anywhere in the country, contact us today for a taste that soothe your desire.